awaka.ru

Our team of professional designers grass installation for Modesto homes and commercial properties. Our goal is to provide a one-of-a-kind outdoor aesthetic in any living space in the region. We offer both residential and commercial artificial turf installation. October 6, - Best Artificial Turf in Modesto, CA - Bay Valley Synthetic Turf, Malone Turf, Turf Masters Solutions, Lifestyle Landscape Design, Bella Turf and Greens, Santini's Landscaping, Artificial Turf By Fenix, Purchase Green Artificial Grass - Manteca, Capote Landscape, JJ Synthetic Grass. October 10, - We specialize in artificial grass installation and experts in building your dream putting green. We proudly serve the Modesto area. Modesto Artificial Grass. likes · 3 talking about this. We are Modesto Artificial Grass, the premiere artificial grass installation company in Modesto. We p. Artificial Turf and Landscape Co. Provides turf and other major landscaping services in the Modesto, CA area. August 13, - Artificial grass from SYNLawn is saving Modesto, CA residents time & money in lawn care & is environmentally sound. Schedule a free consultation today! February 28, - NexGen Lawns Artificial Grass Modesto. Artificial Turf and Fake Grass for homes, lawns, putting greens, dog runs, batting cages, & more in California. Hire the Best Synthetic Grass Installers in Modesto, CA on HomeAdvisor. Compare Homeowner Reviews from 3 Top Modesto Synthetic Grass for Play Area Install services. Get Quotes & Book Instantly. April 12, - Our Artificial Turfartificial grass looks and feels like real grass, and pays for itself in maintenance cost! You’ll never have to worry about dreaded dead spots or weeds ever again. With artificial grass you’ll always be ready to entertain and enjoy your outdoor space. With water conservation restrictions in Modesto. We cannot provide a description for this page right now. 42 reviews of Westurf Nursery "When we bought our house a few years ago the front yard was so hideously overgrown and just old looking. Full of weird giant hedges and some oleander, gross. So we yanked it all out and started over. West turf was where we spent A LOT of money for about months. Find 6 listings related to West Turf In Modesto California in Modesto on awaka.ru See reviews, photos, directions, phone numbers and more for West Turf In Modesto California locations in Modesto, CA. Get reviews, hours, directions, coupons and more for West Turf. Search for other Garden Centers on The Real Yellow Pages®. Westurf carries a wide variety of plants; decorative, vegetable, and herbs. Selection varies by season. Find 7 listings related to West Turf Nursery in Modesto on awaka.ru See reviews, photos, directions, phone numbers and more for West Turf Nursery locations in Modesto, CA. Get reviews, hours, directions, coupons and more for Westurf Nursery. Search for other Nurseries-Plants & Trees on The Real Yellow Pages®. Westurf Nursery is your one-stop shop for all of your outdoor awaka.ru you are concerned about parking, you shouldn't be. There are plenty of parking. November 12, - Top 10 Best West Turf in Modesto, CA - April - Yelp - West Coast Turf, Westurf Nursery, Morris Nursery, Bella Turf and Greens, Artificial Turf By Fenix, Act of Sod. June 15, - Moovit helps you to find the best routes to West Turf using public transit and gives you step by step directions with updated schedule times for Bus in Modesto.

To support our service, we display Private Sponsored Links that are relevant to your search queries. These tracker-free affiliate links are not based on your personal information or browsing history, and they help us cover our costs without compromising your privacy. If you want to enjoy Ghostery without seeing sponsored results, you can easily disable them in the search settings, or consider becoming a Contributor. Westurf Nursery is a locally owned and operated nursery serving the Central Valley for all your gardening needs. . 57 reviews of Westurf Nursery "When we bought our house a few years ago the front yard was so hideously overgrown and just old looking. Full of weird giant hedges and some oleander, gross. So we yanked it all out and started over. West turf was where we spent A LOT of money for about months . Erstelle ein Konto oder melde dich bei Instagram an. Mit Instagram kannst du Fotos aufnehmen, bearbeiten und teilen sowie Videos und Nachrichten an Freunde und deine Familie senden. Lass deiner Kreativität freien Lauf. . We cannot provide a description for this page right now . People use Yelp to search for everything from the city's tastiest burger to the most renowned cardiologist. What will you uncover in your neighborhood? . See posts, photos and more on Facebook . 30 Faves for WESTURF NURSERY from neighbors in Modesto, CA. Connect with neighborhood businesses on Nextdoor. . City of Modesto water customers may be eligible for a rebate when they replace their grass with polyethylene/nylon artificial turf products or any qualifying drought tolerant landscape products. . The Document Center is for storage of documents of many different file types. Documents stored in the Document Center can be separated by folders and subfolders. . In accordance with the requirements of Title II of the Americans with Disabilities Act (“ADA”) of , the Fair Employment & Housing Act (“FEHA”), the Rehabilitation Act of (as amended), Government Code section and other applicable codes, the City of Modesto (“City”) . If you enjoy Ghostery ad-free, consider joining our Contributor program and help us advocate for privacy as a basic human right.

NEWS

1 - 11 - 2025

June 15, - Moovit helps... West Turf In Modesto - Find 7 listings related to West Turf Nursery in Modesto on awaka.ru See reviews, photos, directions, phone numbers and more for West Turf Nursery locations in Modesto, CA. October 10, - We specialize in artificial grass installation and experts in building your dream putting green. We proudly serve the Modesto area..West Turf In Modesto.We cannot provide a description for this page right now.

1 - 7 - 2025

May 29, - Experience city... Condos In Bristol Va - November 14, - Are There Still Condo Buyers in Reston? - Reston, VA - How much has COVID impacted Reston condo sales? Find out which communities are still hot and which are not. Damascus VA Homes for Sale and Real Estate. American Dream Real Estate Group, Inc. specializes in Homes and Listings, representing both Home Buyers and Home Sellers..Condos In Bristol Va.Condos for sale in Bristol County, VA. Discover the latest condo developments and find your ideal apartment with Point2. Browse through nearby listings to find condos suited for both first-time and experienced homebuyers. You can filter your search by price, size and more.

9 - 10 - 2024

Interactive weather map allows you... Lithia Fl - Sieh dir auf Facebook Beiträge, Fotos und vieles mehr an. Find the top 15 cities, towns, and suburbs near Lithia, FL, like Bloomingdale and Brandon, and explore the surrounding area for a day trip..Lithia Fl.Zillow has homes for sale in Lithia FL. View listing photos, review sales history, and use our detailed real estate filters to find the perfect place.

2 - 1 - 2023

Welcome to a beautiful hidden... Bayport Beach And Tennis Club Rentals - Realtime driving directions to Bayport Beach & Tennis Club, Bayport Way, Longboat Key, based on live traffic updates and road conditions – from Waze fellow drivers. Welcome to a beautiful hidden gem of tropical paradise on Longboat Key. The Bayport Beach and Tennis Club, designed by Tim Seibert, one of the founding Architects of the..Bayport Beach And Tennis Club Rentals.See Condo for rent at Bayport Way in Longboat Key, FL from $ plus find other available Longboat Key condos. awaka.ru has 3D tours, HD videos, reviews and more researched data than all other rental sites.

9 - 28 - 2024

WE ARE BEACH LOVERS, and... Vrbo North Litchfield Beach Sc - pet friendly vacation rentals to book online from $95 per night direct from owner for Litchfield Beach. Vacation rentals available for short and long term stay on Vrbo. Secure online payment. 24/7 Customer Service. North Litchfield - Learn all about North Litchfield and browse our vacation rentals today..Vrbo North Litchfield Beach Sc.

Add cards to Google Wallet and tap to pay with them at the world's leading retailers. Put your old wallet away; your phone's got this. Learn more about in . Order your handcrafted leather wallet today. Made in Maine from American cow hide, ORIGIN™ genuine leather wallets feature heavy-duty corded stitching for . Shop All Wallets at MCM. Enjoy free ground shipping with every order. . Quality made in America durable coated canvas ID wallet key chain with leather patch to personalize with initials or monogram. . Browse Perry Ellis' selection of stylish men's wallets that easily fit into your pocket. Available in multiple styles, all adding a touch of sophistication. . Money organizers come in all shapes, sizes and colors — and at Fossil, we've designed them with you in mind. You'll find cool wallets that fit your taste and . Shop our selection of men's leather wallets crafted by expert artisans from genuine buffalo leather with a two-year workmanship guarantee in US. . wallet, minimalist wallet, slim wallet, carbon fiber wallet, wood wallet, RFID protect wallet, RFID blocking wallet, credit card wallet, gift. . VIP Email Sign Up T. Anthony, Proud to be part of your journey since American Heritage. .

Westurf Nursery is a locally owned and operated nursery serving the Central Valley for all your gardening needs.

57 reviews of Westurf Nursery "When we bought our house a few years ago the front yard was so hideously overgrown and just old looking. Full of weird giant hedges and some oleander, gross. So we yanked it all out and started over. West turf was where we spent A LOT of money for about months. Erstelle ein Konto oder melde dich bei Instagram an. Mit Instagram kannst du Fotos aufnehmen, bearbeiten und teilen sowie Videos und Nachrichten an Freunde und deine Familie senden. Lass deiner Kreativität freien Lauf. We cannot provide a description for this page right now. People use Yelp to search for everything from the city's tastiest burger to the most renowned cardiologist. What will you uncover in your neighborhood? See posts, photos and more on Facebook. 30 Faves for WESTURF NURSERY from neighbors in Modesto, CA. Connect with neighborhood businesses on Nextdoor. City of Modesto water customers may be eligible for a rebate when they replace their grass with polyethylene/nylon artificial turf products or any qualifying drought tolerant landscape products. The Document Center is for storage of documents of many different file types. Documents stored in the Document Center can be separated by folders and subfolders. In accordance with the requirements of Title II of the Americans with Disabilities Act (“ADA”) of , the Fair Employment & Housing Act (“FEHA”), the Rehabilitation Act of (as amended), Government Code section and other applicable codes, the City of Modesto (“City”).

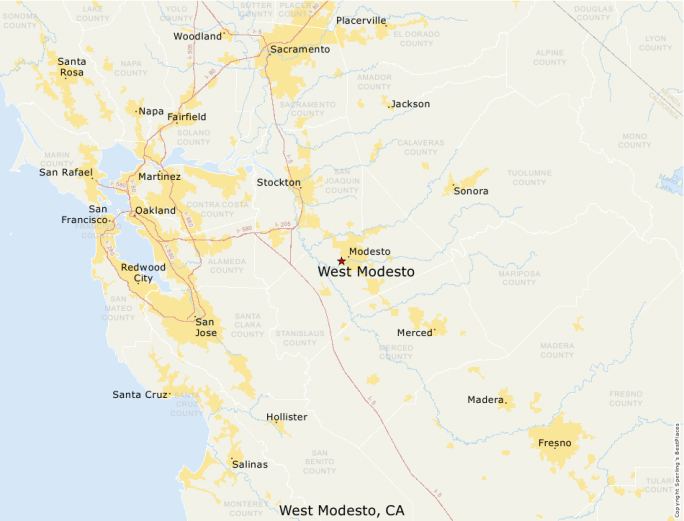

Are you the business owner of Westurf Nursery?Claim your listing. Golden West Market Reviews Hi there!Be the first to review! 1 Disappointing Click to Rate Address: Paradise Rd, Modesto, CA People Also Vie . J S West Feed Store Be the first to review! CLOSED NOW Toda 1 Disappointing Click to Rate Address: 9th St, Modesto, CA People Also Viewed Mo . All MJC students are invited to experience the Innovation Center in Yosemite on West Campus. 3D print, laser cut, vinyl print, sew and more. The Innovation Center is open to al . Head Hunters West More Info Payment method cash, mastercard, debit, visa AKA Head Hunters Yes Address: Coffee Rd, Modesto, CA People Also Viewed Salon Coffee R . Jun 20, - will go to 21 parks where some of the turf is little used by Woodrow, Chrysler 99, Eisenhut, Freedom, West Basin, Ustach, Marie Alvarado-Gil, D-Jackson, whose district takes in Modes . Visit our new website at awaka.ru Plant From: $ $ Dozen Assorted Roses From: $ $ Show More Products Loading Products West Modesto is a Census-Designated . Modesto Performing Arts, CA, United States Hailed by critics as one of the major hits in theatrical history, West Side Story is a re-telling of Romeo and Juliet, with its action se . West Valley vs. Modesto Larissa Higgins Sydney Heming Larissa Higgins Natalie Clevenger Abigail Desa Laris . West Valley vs. Modesto Zachary Kassak Ran Souva Hamish Bonnar Nathaniel Cazares Ante Buzov Bendeguz Aubel .

[A list of air quality inspections performed in the previous month. Citizen Contact Center Complaints Citizen Contact Center Complaints Citizen Contact Center Complaints Citizen Contact Center Complaints Citizen Contact Center Complaint. See Also painting, roofing, decks, and more Mobile Tree Removal Services offers the highest-quality tree service in Mobile, AL, including trimming and full-scale removal, for residential and commercial properties. All work guaranteed, so call the pros at. Classic cars and bicitaxis, similar to pedicabs, sputter through the streets of Centro Habana in the early morning hours. LÁZARO LÓPEZ, Cuba About this series Funding for international reporting by The Seattle Times is provided by a grant from the Seattle. Incorporating REVIEW OF INTERNATIONAL BROADCASTING edited by Glenn Hauser, awaka.ru Items from DXLD may be reproduced and re-reproduced only if full credit be maintained at all stages and we be provided exchange copies. DXLD may not be. Jarl Dr,Gaithersburg, MD Former addresses: Park Ave, Schenectady, NY 36 7th St #5W, New York, NY PO Box, Olney, MD Fast #1, Farmville, VA 84th St #4C, Jackson Heights, NY 21 Madison Ave, Saratoga. A data type for Vehicle Make (VMA) and Brand Name (BRA) Field Codes by Manufacturer. The primary site for this blog mirror is Dissecting Leftism is (and mirrored The My Email me (John Ray Click "Refresh" on your browser if background colour is missing) See or for the archive index of this site. Nicholas D. Kristof has been on a roll lately, calling for Africans to use in his last column and to in his MONT-BELO, Congo Republic There’s an ugly secret of global poverty, one rarely acknowledged by aid groups or U.N. reports. It’s a blunt truth that. by Margaret Ferguson Throughout the long first months of the pandemic—from March to November —I volunteered as a phonebanker for “Indivisible Yolo the local chapter of a national movement devoted to defeating Trump and electing Democrats up and down t. I've been hearing good things about D-Lo. Things like "Modesto, CA native D-Lo blows up despite doing jail time Things like "D-Lo's 'No Hoe' is the biggest West coast hit since 'Tell Me When to Go' by E Things like "D-Lo is so big in the streets that S. IKF RINGSIDENEWSAUGUST IKF PAGE LINKS FRIDAY, August 30th, , AT PM, PT and LTD Productions Present HOT AUGUST FIGHTS!IKF SAN SHOU WORLD TITLE!Ott Vs MarinobleIn Redding CA, USA! The time is NOW for Rudi OttAbove Left) of San Jose, Californi. ODESSA COLLEGE CHECK REGISTER FOR THE PERIOD: 06/01/16 THROUGH 06/30/16 Accounts Payable Wires Comptroller of Public Accounts State Sales Tax Student Disbursements Financial Aid Refunds , Debt Service Payments , Bond Construction. August 18, min read Idyllic settings and lush greens at golf courses are the product of a global research effort working hard to prepare the industry for global warming By GREAT FALLS, Va Tom Lipscomb knows the precise spot on the 18th hole that wilt. USD CAD EURO USD CAD EURO Weekly Monthly Annually Contact us at TheAutomaticEarth •at• gmail •dot• com Timothy H. O'Sullivan He sleeps where he fell May Spotsylvania Court House, Virginia. Dead Confederate soldier near Mrs. Alsop's house. Grant's Wild. Last week I baked focaccia (using roughly the recipe in so this week I’ll try a different Italian bread: pane integrale, based on the recipe Marcella Hazan’s More Classic Italian Cooking. Despite the name, only about of the flour is whole-wheat flour. I’m. By On The third issue is emotional self-regulation. Most of us have routines, things we do every day. Get up, coffee, light breakfast, drive to work, work, chat with co-worker, have lunch, work a bit more, goof of on the internet, etc, etc. We’ve figured. At The New Yorker: My Own Memoir More memoirs have been written on the theme Me and the New Yorker than about the Spanish-American War or homesteading in Nebraska or train trips down South America way, which is a tribute to its legendary editors Harold Ro. For those who love both baseball and travel, it's a natural fit to combine the two. If there is a place in the country where you've never been and want to visit, you can combine it with when your team is also there. There is something thrilling with watch. Buyout Footage Historic Stock Footage Archive Newsreels: Events At Home And Abroad Newsreels stock footage documents world events, politics and war as well as sports, fashion and entertainment for the year of Our Public Domain Stock Footag. BIRMINGHAM, AL (WBRC A burglar got more than he bargained for when he targeted the wrong house in Jefferson County. The woman he was trying to steal from fought back and shot him I was awakened with a gun in my face hollering 'give me all yo money and giv. -Mistah F.A.B. grew up in North Oakland where he attended Oakland Technical High School. He is signed to Bay Area rap legend Mac Dre’s label, Thizz Entertainment and Atlantic Records. F.A.B. has worked with many top Hip-Hop artists including Paul Wall, To. Search for: I decided to try my hand at redistricting California’s Congressional districts for , using After playing around with it a bit, here’s what the map I came up with looks like overall: Here’s the Obama/McCain vote in California, on. The Grand Piano: An Experiment in Collective Autobiography Rae Armantrout, Steve Benson, Carla Harryman, Lyn Hejinian, Tom Mandel, Ted Pearson, Bob Perelman, Kit Robinson, Ron Silliman, and Barrett Watten Mode A/This Press , pages 90/full set ISB. Regardless of that the first tracks up for download are Pooh Man's 'Ant Banks Dis' which is a skit dissing Banks (the man responsible for the MC Ant production and most of the early Dangerous stuff) for not writing his own lyrics (I read a Banks interview. Ed Hardy, the president of Curry Company, was closely associated with Mariposa County officials, in particular, Mariposa District Attorney Bruce Eckerson, County Assessor Steve Dunbar, and Congressman Tony Coelho, whose district encompassed Mariposa and t.